|

|

Filing Case in ECF (Open a BK Case)

Last Updated: April 21, 2025

Manual Opening of a Bankruptcy Case

Note: It is important to complete all steps in this procedure.

-

Prepare Case Opening Documents - Save as a PDF

-

Voluntary Petition

-

Create a single PDF containing Petition, Schedules, and Matrix.

-

Document Order: Petition, Summary, Schedules A/B-J, Statement of Financial Affairs, Statement of Intent (if applicable), Attorney Fee Disclosure, and Matrix.

-

Create separate PDFs of the following documents: Statement of Social Security Number; Certificate(s) of Credit Counseling; Statement of Monthly Income; and Employee Income Records.

A. New Bankruptcy: Initial Case Opening/Petition

-

Log into CM/ECF.

-

Select Bankruptcy > Select Open a BK Case.

-

Leave Case Number Blank.

-

Refer to jurisdictional map to determine Office. (Eau Claire or Madison)

-

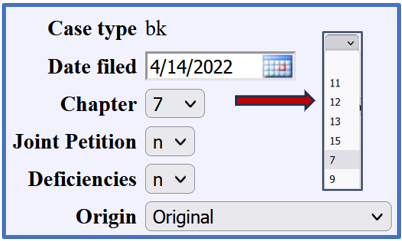

Enter Case Information

-

Chapter: Select Bankruptcy Chapter (7, 11, 12 or 13).

-

Joint Petition: Select “yes” if Joint Petition (joint debtor).

👉 NON-DEBTOR SPOUSE:

Add a Non-Debtor Spouse as a party AFTER the case is open (but BEFORE Judge/Trustee Assignment)

-

DO NOT designate the case as a Joint Petition.

-

The non-debtor spouse information is reported on Form 121 and should include the Social Security Number.

-

Deficiencies: Select “yes” if case is deficient, i.e. missing schedules, employee income records, plan, etc.

-

Origin: Defaults to Original.

-

Add Debtor

-

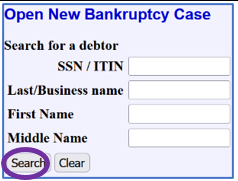

Search for Debtor Party Record

-

Update Debtor Information screen:

-

Existing Party Record:

-

New Party Record:

-

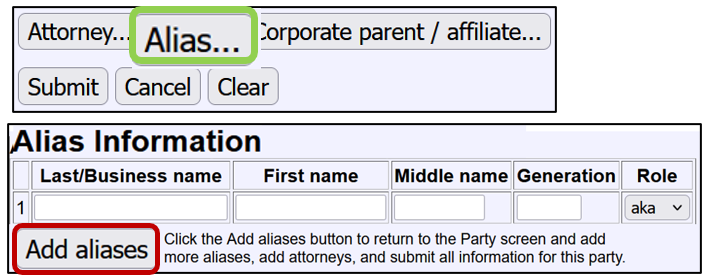

Add Aliases

-

Add Joint Debtor

-

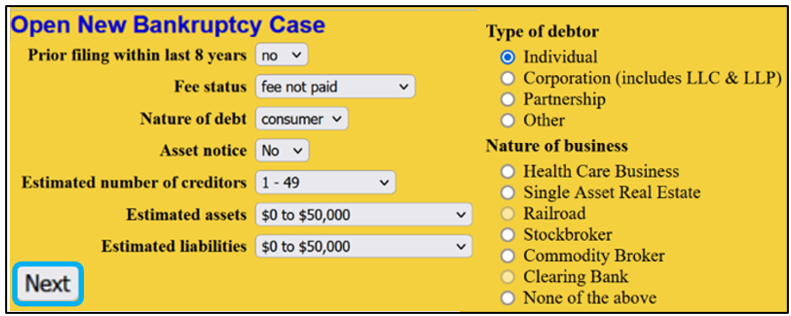

Statistical Information Screen:

-

Prior Filing within last 8 years. Select 'Yes' or 'No'

-

Fee Status: Select “Paid,” “Installments,” or "fee not paid"

Note: Select "fee not paid" when filing an Application to Waive Filing Fee.

-

Nature of Debt: Select "business" or “consumer”

Note: Chapter 9 and 12 must ALWAYS be entered as [b] business. If business, must also select "Nature of business."

-

Asset Designation. Chapter 7's are always entered as No Asset. Chapter 11, 12, 13 are entered as Asset.

-

Estimated Number of Creditors, Assets and Debts. Select the appropriate number or amount.

-

Type of Debtor: Such as individual, corporation, etc.

-

Nature of Business: Business or Consumer

-

Review information; Click Next.

-

Summary of Schedules Screen: Enter values from the corresponding schedules. Details

-

Additional Data Screen: Attorney filers will Enter values from the corresponding schedules and means test. Details

-

Deficiency List Screen:

Note: ONLY for cases missing schedules, plan, etc.

-

Select the appropriate box, (i.e. Schedules A/B-J, Statement of Financial Affairs, Disclosure of Attorney Compensation, Statement of Monthly Income, Employee Income Records).

-

Browse to select the Voluntary Petition (pdf file); Click Next.

Important: PDF copy of Voluntary Petition must contain the redacted Social Security Number.

-

Incomplete Filings Deadline: Keep Due Date (calculated automatically). Click Next.

-

Presumption of Abuse (Only for Chapter 7 individual cases with primarily consumer debts)

-

Filing Fee

-

Docket Text

-

Modify text, if applicable.

-

Verify filing entry is correct before submitting the “Final Docket Text.”

-

Completion of Case Opening

-

The Initial Case Opening concludes with the Notice of Bankruptcy Case Filing Screen.

-

To Print, click the Notice of Bankruptcy Case Filing hyperlink.

-

The Attorney filers may want to save the Notice of Electronic Filing.

B. New Bankruptcy Case: Add Creditors/Judge/Trustee

-

Creditor Matrix

-

Judge/Trustee Assignment

C. New Bankruptcy: Required Documents

-

Statement of Social Security

-

Certificate of Credit Counseling

- Due w/in 14-Days of Case Filing

-

Statement of Monthly Income

-

Employment Income Records

-

Chapter 13 Plan (ONLY Chapter 13 Cases)

|

|

|

|

|